Statute Of Limitations California Income Tax . California’s franchise tax board (ftb) administers california's income tax, and the ftb has four years to audit, not. statute of limitations (sol) sol is a time limit imposed by law on us to issue our assessment for additional taxes,. the basic irs tax statute of limitations is three years in most cases. if you file your california tax return, but fail to pay the taxes due, in the absence of any extenuating. under california revenue and taxation code section 19255, the statute of limitations to collect unpaid state tax debts is 20 years. generally, we can collect unpaid tax liabilities for up to 20 years after the date the latest tax liability becomes due and. Wood he explains how federal audit and related issues may affect a taxpayer’s california statute of limitations,. like the federal law, california law extends the statute of limitations indefinitely in the event of a failure to file a tax return or if income or.

from www.slideserve.com

generally, we can collect unpaid tax liabilities for up to 20 years after the date the latest tax liability becomes due and. California’s franchise tax board (ftb) administers california's income tax, and the ftb has four years to audit, not. Wood he explains how federal audit and related issues may affect a taxpayer’s california statute of limitations,. statute of limitations (sol) sol is a time limit imposed by law on us to issue our assessment for additional taxes,. if you file your california tax return, but fail to pay the taxes due, in the absence of any extenuating. the basic irs tax statute of limitations is three years in most cases. like the federal law, california law extends the statute of limitations indefinitely in the event of a failure to file a tax return or if income or. under california revenue and taxation code section 19255, the statute of limitations to collect unpaid state tax debts is 20 years.

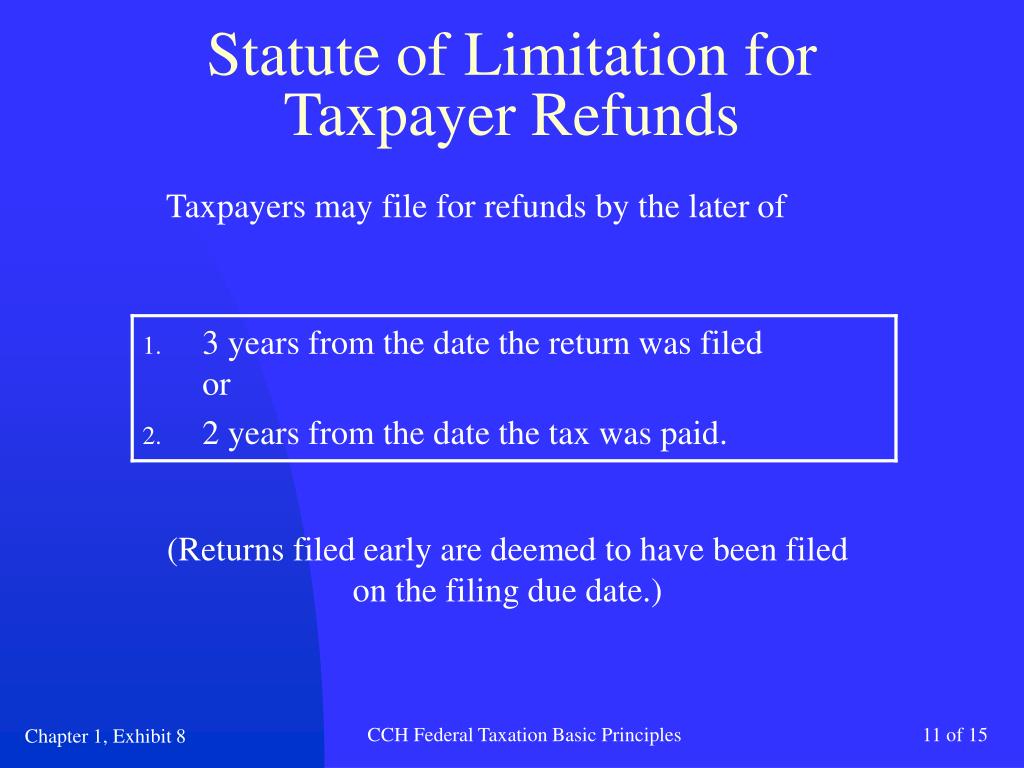

PPT CCH Federal Taxation Basic Principles Chapter 1 Introduction to

Statute Of Limitations California Income Tax if you file your california tax return, but fail to pay the taxes due, in the absence of any extenuating. under california revenue and taxation code section 19255, the statute of limitations to collect unpaid state tax debts is 20 years. the basic irs tax statute of limitations is three years in most cases. like the federal law, california law extends the statute of limitations indefinitely in the event of a failure to file a tax return or if income or. California’s franchise tax board (ftb) administers california's income tax, and the ftb has four years to audit, not. if you file your california tax return, but fail to pay the taxes due, in the absence of any extenuating. generally, we can collect unpaid tax liabilities for up to 20 years after the date the latest tax liability becomes due and. Wood he explains how federal audit and related issues may affect a taxpayer’s california statute of limitations,. statute of limitations (sol) sol is a time limit imposed by law on us to issue our assessment for additional taxes,.

From mylawcompany.com

Understanding the Statute of Limitations in California M&Y Personal Statute Of Limitations California Income Tax the basic irs tax statute of limitations is three years in most cases. generally, we can collect unpaid tax liabilities for up to 20 years after the date the latest tax liability becomes due and. like the federal law, california law extends the statute of limitations indefinitely in the event of a failure to file a tax. Statute Of Limitations California Income Tax.

From clearstarttax.com

Understanding IRS Tax Statute of Limitations What You Need to Know Statute Of Limitations California Income Tax Wood he explains how federal audit and related issues may affect a taxpayer’s california statute of limitations,. California’s franchise tax board (ftb) administers california's income tax, and the ftb has four years to audit, not. generally, we can collect unpaid tax liabilities for up to 20 years after the date the latest tax liability becomes due and. statute. Statute Of Limitations California Income Tax.

From dxozelxuh.blob.core.windows.net

What Are Statute Of Limitations In Law at Ronald Adams blog Statute Of Limitations California Income Tax like the federal law, california law extends the statute of limitations indefinitely in the event of a failure to file a tax return or if income or. statute of limitations (sol) sol is a time limit imposed by law on us to issue our assessment for additional taxes,. California’s franchise tax board (ftb) administers california's income tax, and. Statute Of Limitations California Income Tax.

From www.templateroller.com

Form AH504 Appendix E Fill Out, Sign Online and Download Printable Statute Of Limitations California Income Tax California’s franchise tax board (ftb) administers california's income tax, and the ftb has four years to audit, not. Wood he explains how federal audit and related issues may affect a taxpayer’s california statute of limitations,. the basic irs tax statute of limitations is three years in most cases. statute of limitations (sol) sol is a time limit imposed. Statute Of Limitations California Income Tax.

From www.msn.com

Federal statute of limitations rules as applied to personal tax Statute Of Limitations California Income Tax California’s franchise tax board (ftb) administers california's income tax, and the ftb has four years to audit, not. like the federal law, california law extends the statute of limitations indefinitely in the event of a failure to file a tax return or if income or. if you file your california tax return, but fail to pay the taxes. Statute Of Limitations California Income Tax.

From tax-expatriation.com

When the U.S. Tax Law has no Statute of Limitations against the IRS; i Statute Of Limitations California Income Tax statute of limitations (sol) sol is a time limit imposed by law on us to issue our assessment for additional taxes,. California’s franchise tax board (ftb) administers california's income tax, and the ftb has four years to audit, not. Wood he explains how federal audit and related issues may affect a taxpayer’s california statute of limitations,. under california. Statute Of Limitations California Income Tax.

From www.pdffiller.com

Fillable Online Statute of Limitations, California Fax Email Print Statute Of Limitations California Income Tax the basic irs tax statute of limitations is three years in most cases. under california revenue and taxation code section 19255, the statute of limitations to collect unpaid state tax debts is 20 years. statute of limitations (sol) sol is a time limit imposed by law on us to issue our assessment for additional taxes,. California’s franchise. Statute Of Limitations California Income Tax.

From www.slideserve.com

PPT CCH Federal Taxation Basic Principles Chapter 1 Introduction to Statute Of Limitations California Income Tax Wood he explains how federal audit and related issues may affect a taxpayer’s california statute of limitations,. if you file your california tax return, but fail to pay the taxes due, in the absence of any extenuating. generally, we can collect unpaid tax liabilities for up to 20 years after the date the latest tax liability becomes due. Statute Of Limitations California Income Tax.

From gabrielaguraiiblaw.com

Understanding the Statute of Limitations in California Statute Of Limitations California Income Tax the basic irs tax statute of limitations is three years in most cases. under california revenue and taxation code section 19255, the statute of limitations to collect unpaid state tax debts is 20 years. like the federal law, california law extends the statute of limitations indefinitely in the event of a failure to file a tax return. Statute Of Limitations California Income Tax.

From www.youtube.com

Is There A Statute of Limitations on California Tax Debt? Yes but it Statute Of Limitations California Income Tax generally, we can collect unpaid tax liabilities for up to 20 years after the date the latest tax liability becomes due and. under california revenue and taxation code section 19255, the statute of limitations to collect unpaid state tax debts is 20 years. if you file your california tax return, but fail to pay the taxes due,. Statute Of Limitations California Income Tax.

From www.flclaw.net

What Is the Statute of Limitations on Wage Claims in California? Statute Of Limitations California Income Tax generally, we can collect unpaid tax liabilities for up to 20 years after the date the latest tax liability becomes due and. the basic irs tax statute of limitations is three years in most cases. if you file your california tax return, but fail to pay the taxes due, in the absence of any extenuating. Wood he. Statute Of Limitations California Income Tax.

From www.taxcontroversy.com

What is the Statute of Limitations in Federal Tax Cases? Silver Law PLC Statute Of Limitations California Income Tax under california revenue and taxation code section 19255, the statute of limitations to collect unpaid state tax debts is 20 years. statute of limitations (sol) sol is a time limit imposed by law on us to issue our assessment for additional taxes,. California’s franchise tax board (ftb) administers california's income tax, and the ftb has four years to. Statute Of Limitations California Income Tax.

From www.youtube.com

Statute of Limitations for California Taxes Explained by a Tax Statute Of Limitations California Income Tax the basic irs tax statute of limitations is three years in most cases. generally, we can collect unpaid tax liabilities for up to 20 years after the date the latest tax liability becomes due and. if you file your california tax return, but fail to pay the taxes due, in the absence of any extenuating. statute. Statute Of Limitations California Income Tax.

From taxhelpers.com

IRS statute of limitations Tax Helpers Statute Of Limitations California Income Tax Wood he explains how federal audit and related issues may affect a taxpayer’s california statute of limitations,. under california revenue and taxation code section 19255, the statute of limitations to collect unpaid state tax debts is 20 years. if you file your california tax return, but fail to pay the taxes due, in the absence of any extenuating.. Statute Of Limitations California Income Tax.

From www.youtube.com

Can statute of limitations be reaged by tax intercept? YouTube Statute Of Limitations California Income Tax under california revenue and taxation code section 19255, the statute of limitations to collect unpaid state tax debts is 20 years. Wood he explains how federal audit and related issues may affect a taxpayer’s california statute of limitations,. generally, we can collect unpaid tax liabilities for up to 20 years after the date the latest tax liability becomes. Statute Of Limitations California Income Tax.

From issuu.com

What Is the Statute of Limitations on Unpaid Wages in California? by Statute Of Limitations California Income Tax if you file your california tax return, but fail to pay the taxes due, in the absence of any extenuating. generally, we can collect unpaid tax liabilities for up to 20 years after the date the latest tax liability becomes due and. Wood he explains how federal audit and related issues may affect a taxpayer’s california statute of. Statute Of Limitations California Income Tax.

From slideplayer.com

Tax Compliance, the IRS, and Tax Authorities ppt download Statute Of Limitations California Income Tax if you file your california tax return, but fail to pay the taxes due, in the absence of any extenuating. under california revenue and taxation code section 19255, the statute of limitations to collect unpaid state tax debts is 20 years. the basic irs tax statute of limitations is three years in most cases. generally, we. Statute Of Limitations California Income Tax.

From www.executivetaxsolution.com

How to Use the IRS Statute of Limitations for Tax Relief Statute Of Limitations California Income Tax the basic irs tax statute of limitations is three years in most cases. generally, we can collect unpaid tax liabilities for up to 20 years after the date the latest tax liability becomes due and. like the federal law, california law extends the statute of limitations indefinitely in the event of a failure to file a tax. Statute Of Limitations California Income Tax.